20+ Tax Calculator Indiana

That means that your net pay will be 44148 per year or 3679 per month. If you make 207000 a year living in the region of Indiana USA you will be taxed 49704.

Streamlined Sales Tax Realsstgb Twitter

See How Much You Can Afford With a VA Loan.

. Select a tax district from the dropdown box at the top of the form. Residents of Indiana are taxed at a flat state income rate of 323. Enter your income and other filing details to find out your tax burden for the year.

This marginal tax rate. Indiana Income Tax Calculator 2021. Your average tax rate is 2077 and your marginal tax rate is.

As an employer you must match this tax dollar-for. If you make 55000 a year living in the region of Indiana USA you will be taxed 10852. Ad Calculate Your Payroll With ADP Payroll.

That means no matter how much you make youre taxed at the same rate. Use our income tax calculator to estimate how much youll owe in taxes. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income.

Process Payroll Faster Easier With ADP Payroll. Free calculator to find the sales tax amountrate before tax price and after-tax price. Income Tax Calculator 2021 Indiana Indiana Income Tax Calculator 2021 If you make 70000 a year living in the region of Indiana USA you will be taxed 10616.

If the homestead deduction is selected this tax bill estimator assumes that 100 of the entered assessed value is eligible for the homestead deduction and credits. Also check the sales tax rates in different states of the US. Indiana state sales tax rate.

New York on the other hand only. If you make 206500 a year living in the region of Indiana USA you will be taxed 49528. 1110 of Assessed Home Value.

Process Payroll Faster Easier With ADP Payroll. Your average tax rate is 2080 and your marginal tax rate is 32. Base state sales tax rate 7.

Indiana Income Tax Calculator 2021. Indiana calculates state taxes based on a percentage of Federal Taxable Income. Ad eFiling Is The Quickest Way To Submit Your Return All From The Comfort Of Your Home.

Your average tax rate is 1686 and your marginal tax rate is. Ad Try Our Free And Simple Tax Refund Calculator. 0830 of Assessed Home Value.

0890 of Assessed Home Value. Your average tax rate. The aggregate of Indian state income tax and local tax applicable in a.

Self Employed Tax Filing With Step-by-step Guidance To Help Maximize Your Deductions. Indiana applies 323 against your State Taxable income of -98000 Federal Tax Calculation for. Indiana Income Tax Calculator 2021.

Get a quick rate range. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. The Indiana Tax Calculator Estimate Your Federal and Indiana Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married Filing Joint Married Filing.

Get Started With ADP Payroll. All counties in Indiana impose their own local. Get Started With ADP Payroll.

Total rate range 7. The district numbers match the district number you receive on your bill. The Indiana tax calculator is updated for the 202223 tax year.

Income Tax Calculator 2021 Income Tax Calculator 2021 Indiana Income Tax Calculator 2021 Indiana 200000 Indiana Income Tax Calculator 2021 If you make 200000 a year living. If you make 126000 a year living in the region of Indiana USA you will be taxed 25286. Get 3 Months Free Payroll.

For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year. The IN Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for. 100 Accurate Calculations Guaranteed.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Calculate Your Payroll With ADP Payroll. Due to varying local sales tax rates we strongly recommend using our calculator.

If you make 116500 a year living in the region of Indiana USA you will be taxed 22699. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Your average tax rate is 1628 and your marginal tax rate is.

To Calculate an Estimate of Your Bill. Get 3 Months Free Payroll.

:max_bytes(150000):strip_icc()/female-small-business-owner-making-a-financial-report-of-her-company-from-a-pie-chart-on-his-laptop-while-sitting-in-an-exclusive-restaurant-1171102644-4da3c27c958c49c09ee9486e59c0e2a8.jpg)

Taxes On Wages And Salary Income

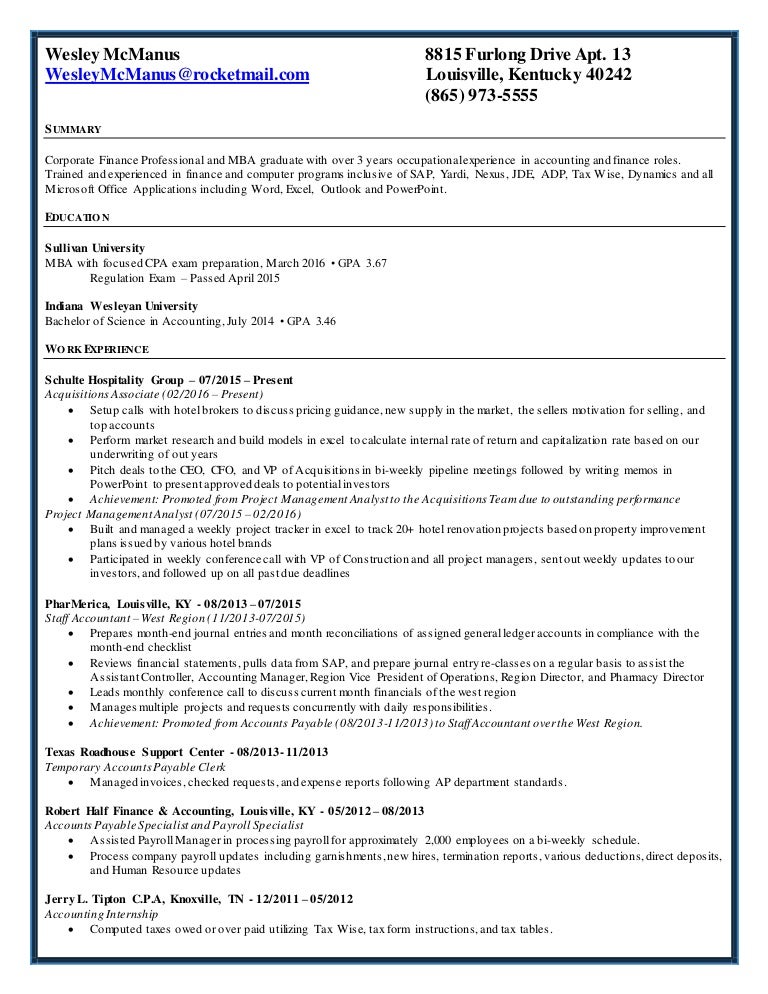

20160613 Wes Mcmanus Resume

136 Indiana Ave Dayton Oh 45410 Mls 496850 Redfin

:max_bytes(150000):strip_icc()/SeniorTaxes-671f84a02cb048d8bc92883af3c17cc2.jpg)

Taxation Of Social Security Benefits

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Home Sale Exclusion From Capital Gains Tax

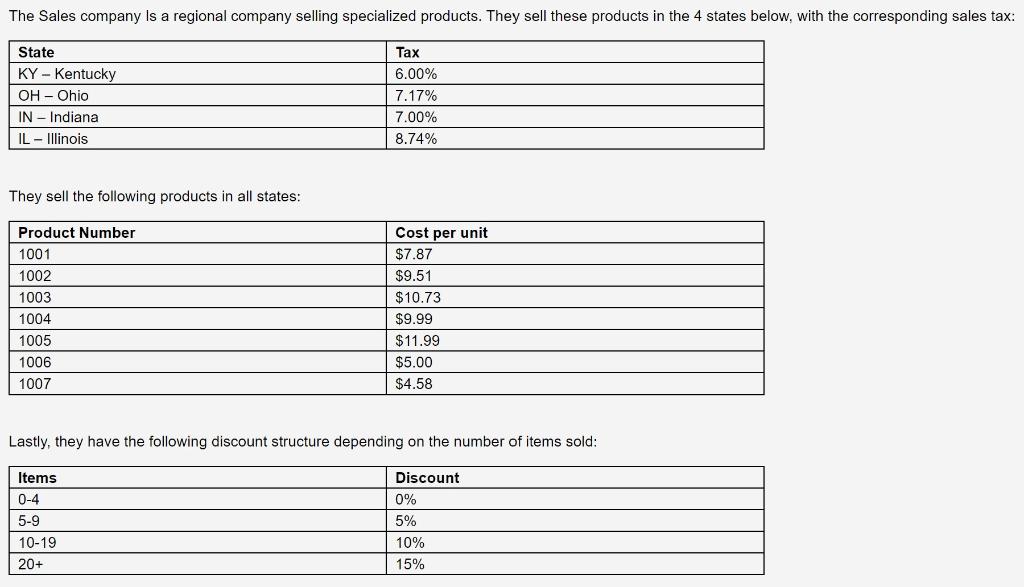

Our Goal Is To Create An App Allowing The User To Chegg Com

Funding Services

Indiana Paycheck Calculator Smartasset

Interest Rates At Kp Continue Rising Decreasing Lump Sum Payments

139 Indiana Ave Dayton Oh 45410 Mls 856916 Redfin

Cash Out Refinance Find My Way Home

May 17 2022 Noblesville By Current Publishing Issuu

Indiana Dry Fruit Nuts Seeds Berries Organic Mix Trial Mix Full Roasted Nutritious And Crunchy Trail Snack 18 Varieties 400gm Amazon In Grocery Gourmet Foods

Harnessing Solar Energy In Indiana Environment Nuvo Net

The Work Opportunity Tax Credit Wotc In Indiana Cost Management Services Work Opportunity Tax Credits Experts

Organic Broadcaster November 2019 Volume 27 Issue 6 By Marbleseed Issuu

Calculation Of The Adjusted Wacc To The Total Value In Billion Pesos Download Scientific Diagram